Why SurfinLab?

With rich experience and deep industry knowledge, SurfinLab can provide customized credit risk assessment solutions to help customers identify, evaluate and manage risks. Our services cover a wide range of aspects, including credit assessment, risk monitoring, overdue collection, legal support, etc., to ensure the maximum benefit of customers

- >99% Accuracy Rate OCR recognition rate,biometric recognition rate,Selfie&ID comparison rate

- >1 billion Neo4j Graph Database Relationship graph has more than one billion nodes around the world

- >4.1 million Credit Score Scored more than 4.1 million users around the world

- >10 thousand Variables User segmentation,text,relationship graph variables

- <24 hours Interception Time Discovering fraud, making strategy,and going online to intercept fraud within 24 hours

Four Major Intelligent Risk Control Products

To provide customer one-stop stable and high-quality risk control services

e-KYC

e-KYC Anti-fraud

Anti-fraud Variables

Variables Credit Score

Credit Score

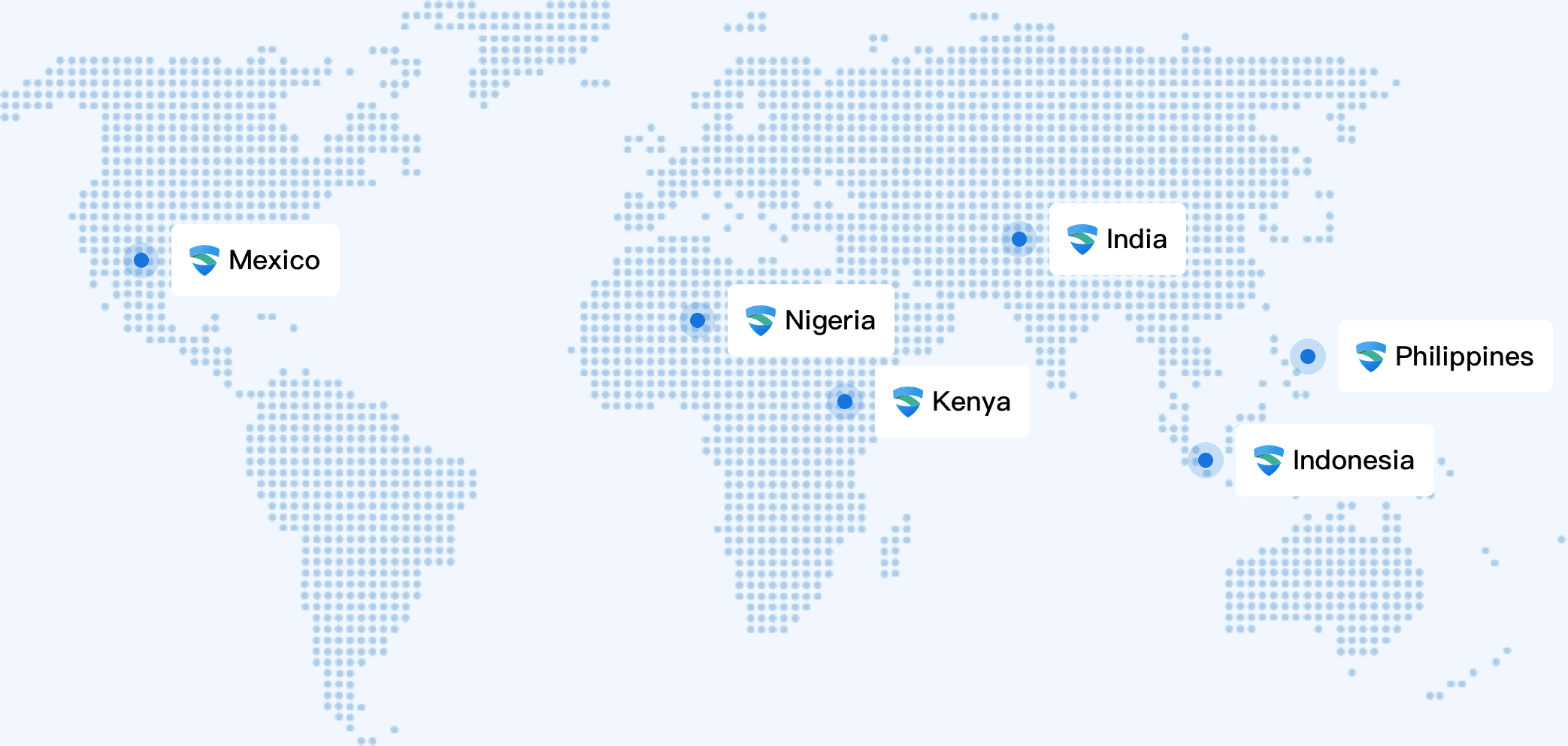

Global Credit Risk Control Services

The service covers Indonesia, Philippines, India, Mexico, Kenya, Nigeria and other countries and regions, providing comprehensive credit risk assessment and risk management services to help customer reduce risks and achieve long-term profitability.

Apply For Free Test

Surfinlab has established sustainable customer relationships with companies in Indonesia, the Philippines, India, Mexico, Kenya, Nigeria and other countries and regions

Contact Us For More Professional Support

There will be personnel to provide you with solutions, professional Q&A, etc.